Your Trusted Partner for Outsourced Bookkeeping & Accounting Services in the USA

Running a business in today’s fast-paced world is not easy. Every decision you make is based on accurate financial data, yet while you’re focusing on operations, sales, and customer satisfaction, bookkeeping and accounting often take a backseat. We can help with that.

We provide outsourced bookkeeping and accounting services designed specifically for U.S. businesses. Partnering with us gives you access to skilled professionals, secure processes, and cutting-edge tools without having to spend money on an in-house finance department.

We act as an extension of your team with our remote bookkeeping and cloud bookkeeping services. We make sure your books are accurate, compliant, and ready for smarter business decisions—from recording daily transactions to ensuring payroll compliance. We prioritize accuracy, scalability, cost savings, and seamless integration with your existing systems – so you can run your business with confidence.

Our Bookkeeping & Accounting Services

For U.S. businesses of all sizes, we provide comprehensive outsourced bookkeeping and accounting services. Our services are tailored to meet your requirements, regardless of your business’s size—startup, small, or established.

General Bookkeeping & Ledger Management

General Bookkeeping & Ledger Management

Every successful business starts with well-organized books. Journal entries, general ledger maintenance, chart of accounts setup, daily, weekly, or monthly bookkeeping, and financial record management are among the services we offer. We provide you with reliable financial reports by making sure they are accurate and consistent.

Accounts Payable (AP) Services

Accounts Payable (AP) Services

Cash flow and vendor relationships depend on seamless payables management. Vendor invoice processing, scheduling payments, and keeping track of expenses are all included in our accounts payable outsourcing services. You can reduce errors, eliminate delays, and maintain outgoing payments transparently with our accounts payable services.

Accounts Receivable (AR) Services

Accounts Receivable (AR) Services

Timely collections are essential to a healthy cash flow. Cash application, collections follow-up, and customer invoicing are all included in our accounts receivable services. To help your business have a steady flow of funds, we make sure invoices are sent out on time, track unpaid invoices, and help reduce outstanding receivables.

Bank & Credit Card Reconciliation

Bank & Credit Card Reconciliation

Accurate financial reporting requires reconciling bank accounts. Every transaction will match your records because of our credit card reconciliation and bank reconciliation services. We maintain your books audit-ready, identify discrepancies, and prevent fraud, so you can feel completely secure about your financial data.

Payroll Processing & Compliance

Payroll Processing & Compliance

Payroll errors can lead to compliance issues and employee dissatisfaction. We calculate salaries, disburse paychecks, and file payroll taxes using our payroll processing services. Forms 941, W-2, and W-3 are all included in our payroll tax filing services, which ensure compliance with state and federal regulations. For all your other tax compliance and filings, we have you covered.

Inventory & Fixed Asset Accounting

Inventory & Fixed Asset Accounting

Proper accounting is essential for businesses that have physical assets and products. We provide fixed asset management solutions, including depreciation schedules and asset value tracking over time, in addition to efficient inventory accounting services. This ensures that you are fully aware of the assets and worth of your business.

Why Outsourced Bookkeeping Matters (Strategic Advantage)

Gaining a competitive edge through outsourced bookkeeping is more important than just saving money. Outsourcing helps many U.S. businesses, especially startups and growing firms, because it allows them to fully focus on growing their businesses while experts take care of compliance and reporting.

Key advantages of outsourcing bookkeeping:

- Enhanced cash flow visibility to aid in decision-making

- Reduced overhead costs when compared to in-house teams

- IRS compliance and non-compliance risk reduction

- Scalability for startups and small businesses needing flexible support

In addition to minimizing risks, outsourcing bookkeeping for startups gives you more time to focus on growth and innovation.

Why Choose Our Bookkeeping & Accounting Services

Because we combine deep knowledge of U.S. compliance regulations with cost-efficiency, security, and expertise, our cost-effective bookkeeping services are unlike any other.

Cost Savings

Cost Savings

Use cost-effective bookkeeping services to reduce expenses by up to 40%.

U.S. Expertise

U.S. Expertise

Everyone on our team has undergone training on IRS regulations and compliance requirements.

Cloud Flexibility

Cloud Flexibility

Skilled in NetSuite, Xero, Sage, and QuickBooks bookkeeping services.

Industry Coverage

Industry Coverage

Serving the manufacturing, e-commerce, healthcare, real estate, and technology sectors.

Data Security

Data Security

Strict confidentiality measures and ISO-certified processes

By choosing Your Accountancy Advisor, you’ll get a long-term financial partner in addition to reliable remote bookkeeping & cloud bookkeeping services.

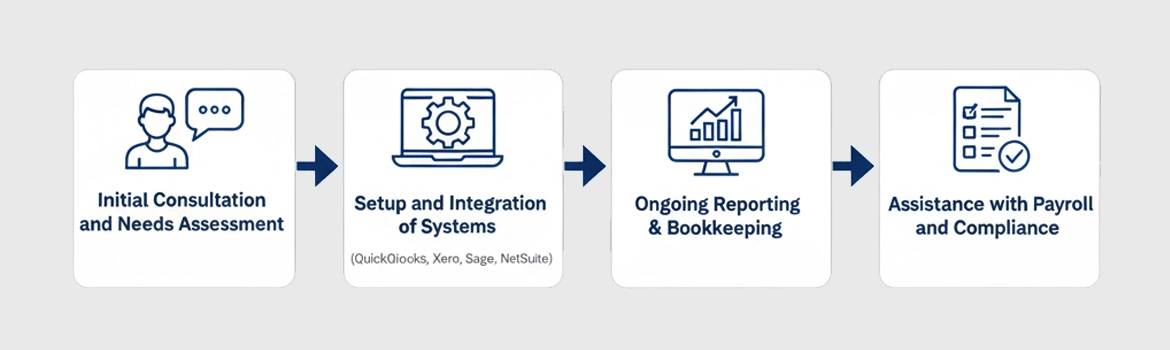

A Transparent & Efficient Remote Bookkeeping Process

Our processes are simple yet effective. You can access your financial data in real time and get seamless reports with our remote bookkeeping solutions.

Our process includes:

- Initial Consultation and Needs Assessment

- Setup and Integration of Systems (QuickBooks, Xero, Sage, NetSuite)

- Ongoing Reporting & Bookkeeping

- Assistance with Payroll and Compliance

- Monthly/Quarterly Financial Reporting

You will always be aware of the financial standing of your business when you use our outsourced bookkeeping services. For more detailed insights, explore our full financial reporting and analysis services.

Serving a Diverse Range of U.S. Clients

Our solutions are designed to assist businesses across a multitude of industries and stages of growth.

Our areas of expertise include:

- Startups & MSMEs: Catch-up bookkeeping and bookkeeping for startups.

- CPA Firms: Efficient CPA firms outsourcing bookkeeping work.

- IT and E-commerce companies: Managing high-volume, digital transactions

- Healthcare providers: Making sure financial processes adhere to HIPAA

- Real estate & construction firms: Project-based accounting and asset management

- Nonprofits: Managing donor reporting requirements and restricted funds

Our small business accounting services ensure that we can adapt to your unique financial needs, regardless of your industry.

Ready to Simplify Your Bookkeeping?

With our comprehensive bookkeeping and accounting services, you can take control of your finances today. Our outsourced bookkeeping services help you in reducing expenses, improving accuracy, and gaining financial clarity.

Request a Free Consultation Today!

Ready to Simplify Your Audit Process?

Frequently Asked Questions

Yes, we offer Xero, Sage, and NetSuite support in addition to QuickBooks bookkeeping services.

Of course. In order to ensure complete compliance, we provide payroll tax filing services, including Forms 941, W-2, and W-3.

Yes, we specialize in bookkeeping for startups, including catch-up bookkeeping and accounting system setup.

We prioritize clear and consistent communication. We use secure cloud platforms for real-time data access and document sharing. We also schedule regular meetings via phone or video conference to review your financial reports and discuss any questions you have.